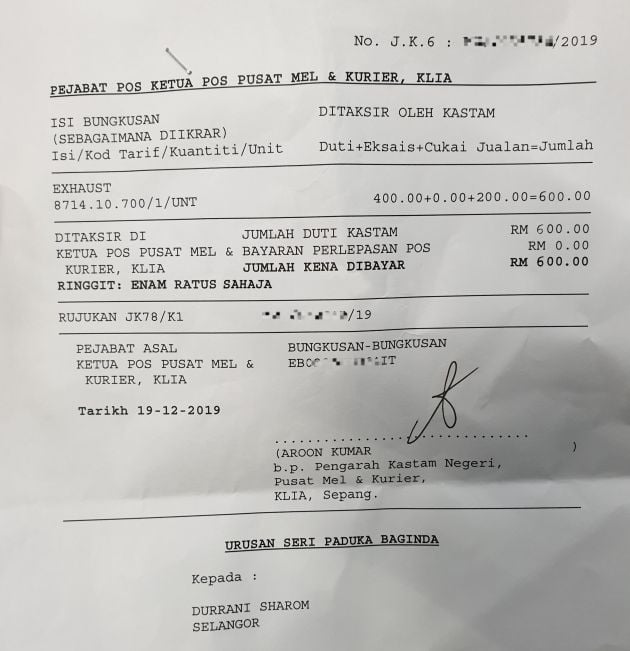

Import Tax Kastam Malaysia

E Garis Panduan Pelepasan Barangan Yang Dibawa Masuk Semula Dari Pelabuhan Kastam Dan Pelabuhan Zon Bebas. Persiaran perdana precinct 3 62100 putrajaya federal territory malaysia httpswwwmyttxcustomsgovmy.

Looking To Purchase Vehicles Parts Online From Overseas Stores Watch Out For Import Duties Taxes Paultan Org

Licensed warehouse which carry on any manufacturing process under section 65A of the Customs Act 1967 iii.

Import tax kastam malaysia. Many product categories like fashion accessories bags luggage audio-video products and health beauty products will have Sales and Service Tax SST imposed on it for shipments valued over RM500. Is the Kastam still imposing an import tax on computer parts. The current browser does not support Web pages that contain the IFRAME element.

603 8882 2288 Fax. The incidence of tax is provided under section 22 of the Sales Tax Act 1972. Larangan Bersyarat Kecuali Dengan Cara Yang Diperuntukan.

Goods subject to 20. D Threshold Any person providing taxable services liable to be registered if the total amount of taxable services provided by him in 12 months exceed threshold. Sehubungan dengan itu sebarang pertanyaan dan maklumat lanjut berkaitan GST sila hubungi Pusat Panggilan Kastam 1-300-888-500 atau emailkan ke ccccustomsgovmy.

Section 99 Customs Act 1967 Drawback on imported goods used in manufacture or in packing. GST shall be levied and charged on the taxable supply of goods and services. Page 3 of 130.

You may called to their customer service to check and asked 1st. Perintah Kastam Larangan Mengenai Import 2008 Jadual Keempat. May 8 2020 0433 PM.

For example if the declared value of your items is. Amazon also precharge customs tax when shipping to Malaysia and sometimes at the end of the year they refund me the extra tax they charged me. Labuan Langkawi and Tioman ii.

Upon arrival in Malaysia all goods need to be declared within one month from the date of import by the owner or his agent in the prescribed form. Goods subject to specific rate. Jabatan Kastam Diraja Malaysia Kompleks Kementerian Kewangan No 3.

Download form and document related to RMCD. Sales Tax Imposition Of Tax In Respect Of Designated Area Amendment Order 2021. Perintah Kastam Larangan Mengenai Import 2008 Jadual Ketiga.

Please refer to Sales Tax Goods Exempted From Tax Order 2018 and Sales Tax Rates of Tax Order 2018. Payment Of Sales Tax. From my understanding toy impose 15-25 import tax and 10 sales tax.

1Where any imported goods are re-exported by the manufacturer as part or ingredient of any goods manufactured in Malaysia or as the packing or part or ingredient of the packing of such manufactured goods. In the case of goods imported by road. For self-clearance representative kindly bring along tracking number invoice and a copy of receivers passport or identification card and companys seal Charges quote excluding OGA extra K1 Tax Customs.

The import tax on a shipment will be. Perintah Kastam Larangan Mengenai Import 2008 Jadual Kedua. Import and export of illicit drugs eg.

Prescribed drugs can only be imported into or exported from the country by virtue of a licence issued by the Ministry of Health Malaysia. Subject to an importexport license from the relevant authorities Meat Edible Meat Offal Subject to an importexport license from the relevant authorities This Guide merely serves as information. - nationals and residents of Malaysia have left the.

If the full value of your items is over. Royal malaysian customs department level 4 block a menara tulus. The trafficking of illegal drugs is a serious offence in Malaysia and the penalty for such an offence is death.

Duty rates in Malaysia vary from 0 to 50 with an average duty rate of 574. For payment of taxes online the maximum payment allowable is as follows. In order for the recipient to receive a package an additional amount of.

Tourism tax ttx policy no12021 09042021 announcement for postponement date of dpsp. Larangan Bersyarat Bagi Langkah-Langkah Perlindungan. Imported goods can only be released from customs control after the duty andor tax paid in full except as otherwise allowed by the Director General.

For corporate account payments B2B the amount is RM100 million. Show posts by this member only Post 1782. DUTY DRAWBACK LEGAL PROVISION.

The import tax on a shipment will be. In taxes will be required to be paid to the destination countries government. - all other goods incl.

In general the import tax rate in Malaysia starts from 5 of the shipment value. Gifts and souvenirs up to a total value of max. A single stage tax levied on imported and locally manufactured goods either at the time of importation or at the time the goods are sold or otherwise disposed of by the manufacturer.

Morphine heroine candu marijuana etc are strictly prohibited. Some duties are also based on quantity measurements like weight or volume. Duties chargeable depending on the materials toys are made of.

In addition to duty imports are subject to sales tax VAT and in some cases to excise. Self-clearance Post Malaysia International Hub Jalan KLIA S1 64000-next to Cargo Village. Sales Tax is imposed on imported and locally manufactured taxable goods.

For example if the declared value of your items is. Licensed Manufacturing Warehouse. Tax exemption and import duty exemption under Items 112 and 113 of the Customs Duty Exemption Order 2017.

Not to forgetthey will include the shipping cost as well while calculating how much to charge on your parcel. GST shall be levied and charged on the taxable supply of goods and services. Organization and Customs related matters such as Sales and Service Tax SST.

MYR 400- except goods from Langkawi and Labuan up to a total value of max. Internal Tax Division Sales Tax Branch Royal Malaysia Customs Head Office Level 4 South Block 2G1B Ministry of Finance Complex Precinct 2 Federal Government Administration Center 62596 Putrajaya Malaysia. HS Code Item Description.

Appoint other agent for clearance. -- Choose -- PDK 2017 PDK 2017 ATIGA ACFTA AHKFTA MPCEPA MJEPA AKFTA AJCEP AANZFTA AINDFTA MNZFTA MICECA D8PTA MCFTA MAFTA MTFTA. Goods subject to 5.

In order for the recipient to receive a package an additional amount of. Payment of sales tax and service tax can be made electronically through the MySST system Financial Process Exchange FPX or manually by cheque or bank draft.

10 Tips On Importing Alibaba Wholesale Products From China Export Business Import Business Shipping Container Homes

Komentar

Posting Komentar