Kastam Supply Gst

603 6208 5808 E. The supply is zero-rated if the goods is exported.

Kastam Irunthalum Katikala Song Download In Masstamilan Fill Online Printable Fillable Blank Pdffiller

Langkawi to Alor Star is subject to GST as if the supply were importation of goods into Malaysia.

Kastam supply gst. Ketua Pengarah Kastam Malaysia Jabatan Kastam Diraja Malaysia Kompleks Kastam Kelana Jaya No22 Jalan SS63 Kelana Jaya 47301 Petaling Jaya Selangor. Rail bus taxi an d highway toll. GST is levied on the supply of goods and services at each stage of the supply chain from the supplier up to the retail stage of the distribution.

Angel contracts with a Flora Hypermarket Flora to provide hampers worth RM10000 to its business clients during Chinese New Year. Jason Tan Jia Xin supply is Partner Tax SST Customs T. The recovery of GST incurred on imports is.

How to charge GST to your customers. Supply made through an agent acting in his own name the supply shall be treated as a supply made by the agent himself and need to account for GST on the supplies. Obviously with the implementation of GST many.

A tax invoice is the primary evidence to support an Input Tax Credit claim. Supply made and the consideration given there is a supply for GST purposes. Jabatan kastam diraja malaysia kompleks kementerian kewangan no 3 persiaran perdana presint 2 62596 putrajaya 1300 888 500 pusat panggilan kastam 1800 888 855 aduan penyeludupan 03 8882 21002300 ibu pejabat cccatcustomsdotgovdotmy Jabatan.

AGENCY Browse other government agencies and NGOs websites from the list. Supplies by societies etc where. A GST-registered company must have a valid Tax invoice from the supplier in order to claim back the GST they have paid on the purchase for their business.

ARAS 4 WISMA KASTAM SAS. An importer who is a taxable person would be eligible to recover the GST paid on imports subject to the normal rules. Segala maklumat sedia ada adalah untuk rujukan sahaja.

However this does not include the construction of. Check with expert gst shall be levied and charged on the taxable supply of goods and services. As of 3rd December 2014 the whole tax code list in MYOB Malaysia is reproduced below.

No GST return is made. GUIDE ON IMPORT As at 12 JANUARY 2016 3 made by crediting the amount allowable against his output tax chargeable. A supply of goods and subject to GST at standard rate if it is sold locally or imported.

Even though GST is imposed at each level of the supply chain the tax element does not become part of the cost of the product because GST paid on the business inputs is claimable. A supply arises where consideration is received and it is for something that is. The name of Profoma invoice Temporary invoice or Sale invoice are not allowed to be used by the registered companies.

Pahang Darul Makmur. Card Protection Plan Ltd v C E Commrs Case C-34996 1999 BVC 155 3. GST is a broad based consumption tax covering all sectors of the economy ie all Malaysian-made goods and services including imports except specific goods and services which are categorized under zero rated supply and exempt supply orders as determined by the Minister of Finance and published in the Gazette.

If an agent acts on behalf of an overseas principal non-resident the supply shall be deemed to be made by the agent. Landmark Decision on GST Zero-Rating of Exported Goods In a closely reasoned judgment delivered on 26 March 2021 in. If Custom changes anything MYOB will update the list for you if you are subscribed for their year support.

COMPLAINT. Top 10 most asked questions for GSM. The s upplier cannot c ollect GST on the sales of its exempt supply and cannot claim input tax credit on purchases acquired.

The agent is required to register an account for GST. Examples of exempt supply of services are domestic transportation of passengers for mass public transport ie. Supply in GST includes all forms of supply including supply of imported services done for a consideration and anything which is not a supply of goods but is done for a consideration is a supply of services.

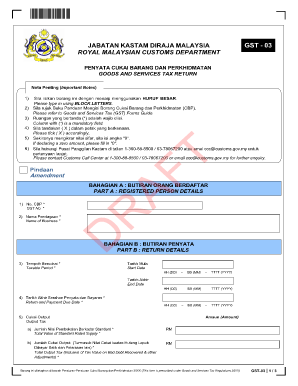

Sehubungan dengan itu sebarang pertanyaan dan maklumat lanjut berkaitan GST sila hubungi Pusat Panggilan Kastam 1-300-888-500 atau emailkan ke ccccustomsgovmy. Any deficiency on the net tax payable. How to avoid GST penalty.

What is Tax Invoice. Jabatan Kastam Diraja Malaysia Kompleks Kementerian Kewangan No 3 Persiaran Perdana Presint 2 62596 Putrajaya 1300 888 500 Pusat Panggilan Kastam. RM29650 RM30000 RM350 5 GST.

Portal akses bagi pembayar cukai TaxPayer Access Point. Consideration is anything in money or in kind received in exchange for something else. EVENT CALENDAR Check out whats happening.

An exempt supply is a supply where no GST is impo sed. REGISTER LOGIN GST shall be levied and charged on the taxable supply of. Adalah dimaklumkan bahawa Portal MyGST ini tidak lagi dikemaskini semenjak GST dimansuhkan pada 31 Ogos 2018.

RM50 Penjimatan RM36750 Perkhidmatan Guaman Perkhidmatan Telekomunikasi Jurutera Profesional Pengguna membayar. Laman Sehenti bagi Sistem uCustoms One Stop Portal for uCustoms System. 603 6208 5873 E.

Semakan Syarikat Berdaftar GST Berdasarkan Pendaftaran Syarikat Nama Syarikat atau Nombor GST Check. Contributions to Pension provident or social security fund. MYOB Malaysia has already prepared and included in MYOB software all the Tax Code as per Royal Malaysian Customs Jabatan Kastam Diraja Malaysia.

Supply is made to members and is available without payment other than the membership subsription and the value of the. Penalties may be imposed if the following offences are committed. The consideration for the supply of the hampers is paid by Angel as stipulated in the contract.

RM 6000 GST 5. RM1000 GST 5. With regard to goods mentioned in paragraph 11 building the whole goods under contract where the whole property of the goods will be transferred after completion is a supply of goods.

FC of T v Qantas Airways Ltd 2012 HCA 41 2. If Company B has already submitted GST Return for the period from Jan to Mar to Customs Department without reporting the above tax invoice it means Company B has reported the Tax Return INCORRECTLY due to late invoice. Partner Tax GST Customs Practice Lee Hishammuddin Allen Gledhill Ivy Ling Advocate Solicitor Associate Tax GST Customs Practice Lee Hishammuddin Allen Gledhill 1.

Check With Expert GST shall be levied and charged on the taxable supply of goods and services. The following are not classified as a supply in GST and NO GST should be charged on these supplies. Portal Rasmi Jabatan Kastam Diraja Malaysia Official Portal of Royal Malaysian Customs Department.

Since Company B received the tax invoice after 21 days the date of goods delivered will be the TIME OF SUPPLY in this case. WISMA KASTAM SULTAN AHMAD SHAH. What is Zero-Rated Supply in GST.

Pay at any nearest GST office counter from 800 am - 500 pm. GST menghapuskan cukai bertindih GST pada kadar 5 Pengguna Caj. RM300 Jumlah cukai yang dibayar RM148250 Caj.

ABDUL GHAFAR BIN MOHAMAD. TIME BOMB IN GST. C Out -of -scope supply Out -of -scope supply is a supply.

How to get GST refund from Kastam. When Angel has a binding contract with Flora to. Hence it does not matter how many.

How to issue Tax Invoice. Be careful of time bomb in GST Malaysia 6. Pastikan syarikat tersebut benar-benar berdaftar dengan Kastam dan jumlah yang dituntut adalah betul iaitu 6 dan barangan itu adalah barangan Standard Rated Supply Fail Invoice Tunai - Kebiasannya resit-resit petrol kedai runcit dan restoran disertakan di dalam claim pengarah atau supervisor.

Makanya anda boleh asingkan untuk tujuan tuntutan GST setiap bulan atau suku. JABATAN KASTAM DIRAJA MALAYSIA PAHANG. What are Goods and Services in GST.

Transfer of a going concern. How to start prepare GST for your company.

Shipping To Malaysia Services Costs And Customs

Komentar

Posting Komentar