Tax Kastam Malaysia

Sehubungan dengan itu sebarang pertanyaan dan maklumat lanjut berkaitan GST sila hubungi Pusat Panggilan Kastam 1-300-888-500 atau emailkan ke ccccustomsgovmy. The Director General may allow FRP upon application in writing to account for tax on invoice basis.

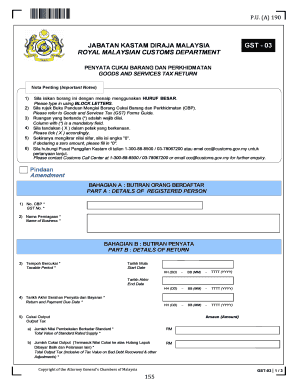

Gst 03 Form Fill Online Printable Fillable Blank Pdffiller

In Malaysia she sales tax charged at 10 is the default sales tax rate.

Tax kastam malaysia. Jabatan Kastam Diraja Malaysia Kompleks Kementerian Kewangan No 3 Persiaran Perdana Presint 2 62596 Putrajaya. Service tax that is a tax charged and levied on taxable services provided by any taxable person in Malaysia in the course and furtherance of business. Vehicles only Submit Excise No.

FSP who provides digital services to consumer in Malaysia and the value of. Prescribed drugs can only be imported into or exported from the country by virtue of. Management Services and Human Resources Division.

All payments via cheque must be made payable to Ketua Pengarah Kastam Malaysia and mailed to the following address. You can also pay all your taxes due via cheque entirely if this option would be easier for you to track your total tax payments over time. Download form and document related to RMCD.

GST shall be levied and charged on the taxable supply of goods and services. Contact Us Jabatan Kastam Diraja Malaysia Kompleks Kementerian Kewangan No 3 Persiaran Perdana Presint 2 62596 Putrajaya Hotline. There are no translations available.

For corporate account payments B2B the amount is. ROYAL MALAYSIAN CUSTOMS DEPARTMENT LEVEL 4 BLOCK A MENARA TULUS NO 22 PERSIARAN PERDANA PRECINCT 3 62100 PUTRAJAYA FEDERAL TERRITORY MALAYSIA https. Item 1 Schedule C.

Morphine heroine candu marijuana etc are strictly prohibited. Ketua Pengarah Kastam Malaysia Jabatan Kastam Diraja Malaysia Pusat Pemprosesan Kastam. New guide on tourism tax dpsp 18082021 panduan am cukai pelancongan versi baharu 09082021 tourism tax ttx policy no12021 09042021 announcement for postponement date of dpsp 06042021 pemberitahuan penangguhan pelaksanaan pppd 06042021 faq ttx pemberi perkhidmatan platform digital 20012021.

The service tax on digital service chargeable under subsection 11 1 STA is due at the time when payment is received for the service provided to the consumer by the FRP. Jabatan Kastam Diraja Malaysia Kompleks Kementerian Kewangan No 3 Persiaran Perdana Presint 2 62596 Putrajaya 1300 888 500 Pusat Panggilan Kastam 1800 888 855 Aduan Penyeludupan 03-8882 21002300 Ibu Pejabat ccccustomsgovmy. Please make your selection.

In addition to duty imports are subject to sales tax VAT and in some cases to excise. -- Choose -- PDK 2017 PDK 2017 ATIGA ACFTA AHKFTA MPCEPA MJEPA AKFTA AJCEP AANZFTA AINDFTA MNZFTA MICECA D8PTA MCFTA MAFTA MTFTA. Jabatan Kastam Diraja Malaysia Kompleks Kementerian Kewangan.

THE PUNISHMENT FOR DRUG TRAFFICKING IS DEATH BY HANGING. For payment of taxes online the maximum payment allowable is as follows. For example if the declared value of your items is.

Uniqlo Malaysia Sdn Bhd v Ketua Pengarah Kastam Dan Eksais Uniqlo was a decision by the Court of Appeal which enumerated the duty to give reasons by tax officers. Zero-rated The main difference between zero-rated and exempted goods is that the zero-rated are taxable supplies taxed at the SST 0 rate whereas exempted goods are non-taxable and not subject to SST. In order for the recipient to receive a package an additional amount of.

A service tax that is charged and levied on taxable services provided by any taxable person in Malaysia in the course and furtherance of business. In taxes will be required to be paid to the destination countries government. Trying to get tariff data.

OPERASI DAN PERKHIDMATAN JABATAN KASTAM DIRAJA MALAYSIA JKDM DALAM TEMPOH PELAKSANAAN PERINTAH KAWALAN PERGERAKAN PKP. The SST replaces the existing Goods and Services Tax GST and affects all domestic and import shipments. Payment of sales tax and service tax can be made electronically through the MySST system Financial Process Exchange FPX or manually by cheque or bank draft.

Malaysia Sales Service Tax SST. The current browser does not support Web pages that contain the IFRAME element. Some goods are not subject to duty eg.

Download the respective format. Laptops electric guitars and other electronic products. The import tax on a shipment will be.

Sales Tax Imposition Of Tax In Respect Of Designated Area Amendment Order 2021. Security Policy Site Map. The case is currently under appeal to the Federal Court.

The SST has two elements. Adalah berkemungkinan operasi dan perkhidmatan JKDM akan mengalami sedikit gangguan dan. Bermula dari 4 Mei 2020 proses penghantaran setem cukai yang telah diluluskan oleh JKDM akan kembali beroperasi seperti biasa.

Any registered manufacturer to importpurchase raw materials components and packaging materials excluding petroleum exempted from the payment of sales tax formerly CJ5. GST shall be levied and charged on the taxable supply of goods and services. 8 and customs form no.

Pelan Antirasuah Organisasi JKDM. The Sales and Services Tax SST has been implemented in Malaysia. HS Code Item Description.

Import and export of illicit drugs eg. 7 together with necessary documents for approval and authorization of movementBagi barangan am Mengemukakan Borang Kastam 3 beserta dokumen sokongan untuk kelulusan. GETTING READY FOR SALES TAX EXEMPTION APPLICATION.

Contact Us Jabatan Kastam Diraja Malaysia Kompleks Kementerian Kewangan No 3 Persiaran Perdana Presint 2 62596 Putrajaya. Duty Rates Duty rates in Malaysia vary from 0 to 50 with an average duty rate of 574. Akademi Kastam Diraja Malaysia AKMAL Information Technology Division.

Komentar

Posting Komentar